Things about Top 30 Forex Brokers

Things about Top 30 Forex Brokers

Blog Article

The Ultimate Guide To Top 30 Forex Brokers

Table of ContentsThe Main Principles Of Top 30 Forex Brokers Getting My Top 30 Forex Brokers To WorkThe Facts About Top 30 Forex Brokers UncoveredMore About Top 30 Forex BrokersRumored Buzz on Top 30 Forex BrokersTop 30 Forex Brokers for BeginnersAbout Top 30 Forex BrokersAbout Top 30 Forex Brokers

Each bar chart stands for one day of trading and consists of the opening rate, highest possible rate, lowest price, and closing price (OHLC) for a trade. A dashboard on the left stands for the day's opening rate, and a similar one on the right represents the closing price.Bar charts for currency trading aid investors determine whether it is a buyer's or seller's market. The top portion of a candle is used for the opening price and highest possible rate point of a money, while the lower part indicates the closing rate and lowest cost point.

Things about Top 30 Forex Brokers

The formations and forms in candlestick charts are used to identify market instructions and motion.

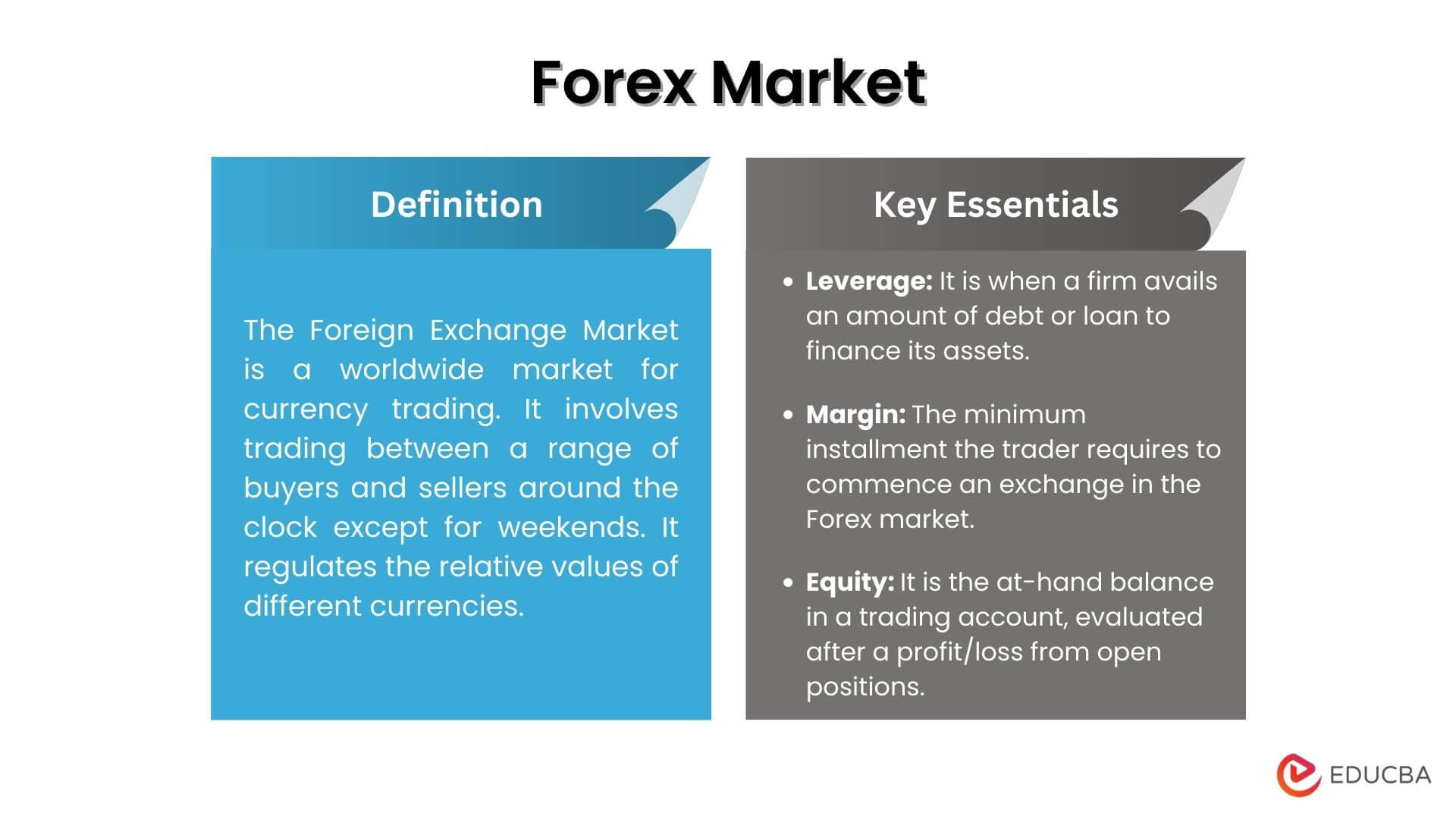

Banks, brokers, and dealers in the forex markets allow a high amount of leverage, meaning traders can regulate huge settings with reasonably little cash. Utilize in the series of 50:1 is usual in forex, though also better quantities of take advantage of are readily available from certain brokers. Nonetheless, utilize needs to be utilized very carefully because numerous inexperienced investors have endured considerable losses using more leverage than was essential or prudent.

What Does Top 30 Forex Brokers Mean?

A currency trader requires to have a big-picture understanding of the economies of the different nations and their interconnectedness to realize the basics that drive money worths. The decentralized nature of foreign exchange markets means it is less regulated than various other economic markets. The extent and nature of policy in foreign exchange markets rely on the trading jurisdiction.

The volatility of a particular money is a feature of several factors, such as the politics and business economics of its nation. Events like economic instability in the type of a repayment default or discrepancy in trading connections with another money can result in considerable volatility.

The Buzz on Top 30 Forex Brokers

The Financial Conduct Authority (https://www.goodreads.com/user/show/174172065-joseph-pratt) (FCA) screens and manages forex trades in the United Kingdom. Money with high liquidity have a ready market and show smooth and predictable cost activity in action to external events. The united state buck is one of the most traded money on the planet. It is coupled up in six of the market's seven most liquid money pairs.

The smart Trick of Top 30 Forex Brokers That Nobody is Discussing

In today's details superhighway the Foreign exchange market is no longer solely for the institutional investor. The last 10 years have actually seen a boost in non-institutional traders accessing the Foreign exchange market and the benefits it offers.

The Definitive Guide to Top 30 Forex Brokers

Foreign exchange trading (forex trading) is an international market for purchasing and selling money - octafx. 6 trillion, it is 25 times larger than all the world's stock markets. As an outcome, rates change constantly for the currencies that Americans are most likely to make use of.

When you market your currency, you obtain the settlement in a various money. Every vacationer who has gotten international currency has actually done foreign exchange Tickmill trading. The trader buys a specific currency at the buy cost from the market manufacturer and sells a various currency at the selling rate.

This is the deal price to the investor, which consequently is the profit made by the market maker. You paid this spread without understanding it when you exchanged your bucks for international money. You would discover it if you made the purchase, canceled your journey, and afterwards attempted to exchange the money back to dollars as soon as possible.

The Buzz on Top 30 Forex Brokers

You do this when you think the money's value will certainly drop in the future. Companies short a money to protect themselves from risk. However shorting is really high-risk. If the currency increases in worth, you need to acquire it from the dealership at that cost. It has the exact same advantages and disadvantages as short-selling supplies.

Report this page